Three major indicators of the economy — imports, remittances and foreign exchange reserves — are likely to increase in the first quarter of the current fiscal year, a positive development for the external accounts, according to the Metropolitan Chamber of Commerce and Industry, Dhaka (MCCI).

Three major indicators of the economy — imports, remittances and foreign exchange reserves — are likely to increase in the first quarter of the current fiscal year, a positive development for the external accounts, according to the Metropolitan Chamber of Commerce and Industry, Dhaka (MCCI).

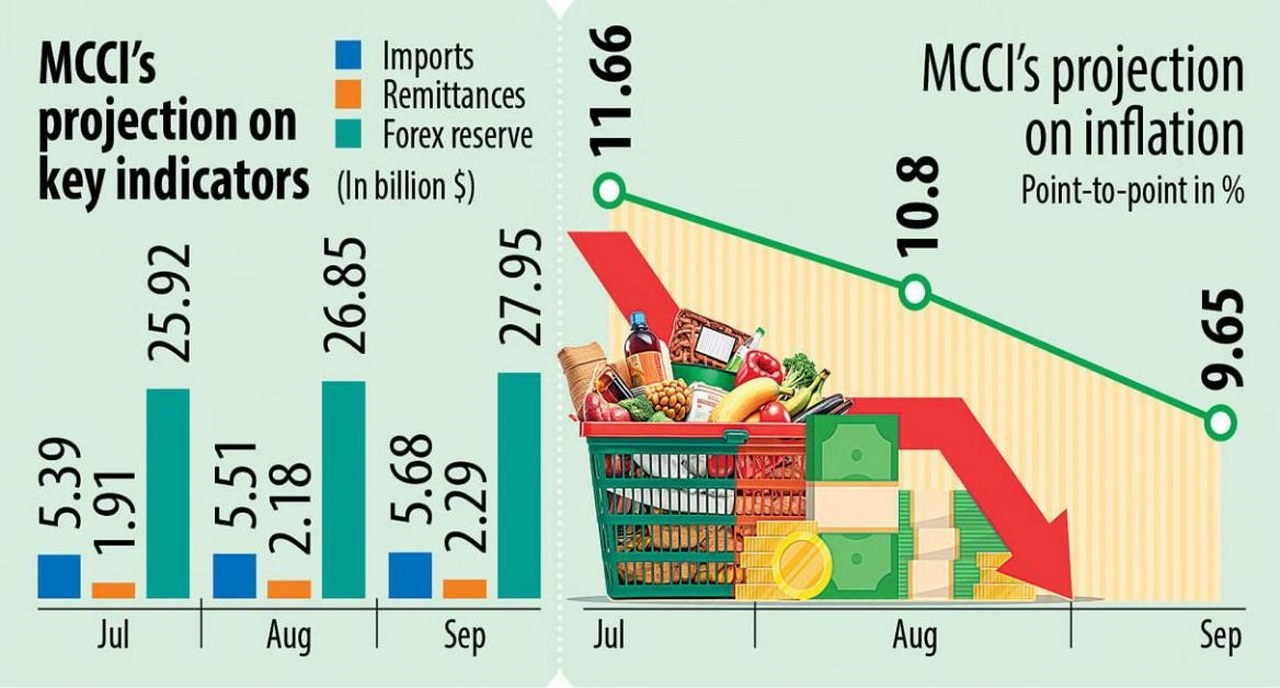

The country’s monthly imports may hit $5.68 billion in September, up from August’s projection of $5.51 billion and July’s estimated import bill of $5.39 billion, the chamber said yesterday in its quarterly economic review.

Similarly, remittances may grow to $2.29 billion next month from $2.18 billion in August.

The leading trade body also said that inflation, which hit 11.66 percent in July, the highest in 13 years, is expected to ease this month and next month.

“The economy is trying to overcome the difficulty due to the present conflicting world scenario. Therefore, the performances of the selected economic indicators are mixed,” the chamber said.

Bangladesh’s overall forex reserves may rise to $27.95 billion at the end of September, it added.

The MCCI did not project exports as the Export Promotion Bureau refrained from publishing export statistics for three months since June after correcting a massive data mismatch.

Imports and remittances may decrease in July due to the present slowed-down economy and then may increase in the next two months, the chamber said, adding that the foreign exchange reserve may decrease in July due to the payment of $1.42 billion for the May-June period through the Asian Clearing Union (ACU).

“Inflation increased in July, but it is expected to fall in August and September of 2024,” it added.

The MCCI said the economy showed some signs of improvement with the increase of foreign exchange reserves and remittances in June of the current year.

But the country witnessed massive mayhem as students protested the quotas system for government jobs since the start of July, which dealt a big blow to business activities.

“After the fall of the Awami League government [on August 5], the interim government has just taken power and it will take time to normalise business activities,” it added.

The MCCI said issues such as smooth logistics, banking services and security in industries needed to be addressed to ensure the revival of economic activities.

It stressed the need to overcome rising inflation, slowdown in external demand, weak remittance inflow, shortfall in revenue collection, slow public expenditure, depreciation of the taka and a decline in foreign exchange reserves.

“The unemployment situation and low investment are other challenges.”

The authorities also need to protect small businesses and ensure proper electricity and gas supply, it added.

The oldest business chamber in the country said agricultural production was good because of favourable natural factors and strong government support.

The manufacturing sector also registered the start of a slow rebound.

The gradual easing of import restrictions, clearance of a backlog of letters of credit, and the introduction of the crawling peg system to manage the exchange rate have spurred economic activity, the MCCI said.

However, the real estate business remains sluggish, mainly because of higher costs of property and lower purchasing power of people.

“Besides, the higher prices of building materials have slowed overall construction work,” it said citing industry people.

“The devaluation of the taka against the US greenback is one of the major reasons for the increase in construction costs. Amid inflationary pressures, labour and transportation costs have also risen.”

The MCCI added that Bangladesh was yet to see tangible economic pickup.

The leading chamber cited that the gross inflows of foreign direct investment (FDI) decreased by 6.5 percent year-on-year to $3.8 billion in the July-May period of FY25.

It noted that FDI inflow to Bangladesh was low compared to many other countries with similar levels of development.

“Bangladesh’s low labour costs are generally believed to be attractive to foreign investors, yet they hesitate to make fresh investments because of the country’s underdeveloped infrastructure,” it added.

The MCCI said other impediments are shortages of energy and weak transmission infrastructure, a lack of consistency in policy and regulatory frameworks, scarcity of industrial land, corruption, and non-transparent and uneven application of rules and regulations.

“The government needs to address these impediments to attract more FDI to the country to ensure the country’s economic development.”

Agrinews24 কৃষির সাথে, কৃষকের পাশে

Agrinews24 কৃষির সাথে, কৃষকের পাশে